fremont ca sales tax rate 2020

Groceries are exempt from the Fremont County and Colorado state. The Fremont Sales Tax is collected by the merchant on all qualifying sales made within Fremont.

California City County Sales Use Tax Rates

The Fremont County Colorado sales tax is 540 consisting of 290 Colorado state sales tax and 250 Fremont County local sales taxesThe local sales tax consists of a 250 county sales tax.

. The tax rate given here will reflect the current rate of tax for the address that you enter. The minimum combined 2022 sales tax rate for Fremont California is. The California sales tax rate is currently.

The minimum combined 2022 sales tax rate for Fremont California is. You can print a 1025 sales tax table here. - The Income Tax Rate for Fremont is 93.

Future job growth over the next ten years is predicted to be 370 which is higher than the US average of 335. About our Cost of Living Index. The statewide tax rate is 725.

The US average is 46. The current total local sales tax rate in Fremont CA is 10250. Did South Dakota v.

The minimum combined 2021 sales tax rate for fremont california is 1025. The december 2020 total local sales tax rate was 9250. The Fremont sales tax rate is.

You can print a 6 sales tax table here. The 2018 United States Supreme Court decision in South Dakota v. We include these in their state sales tax.

The US average is 73. The Fremont Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Fremont local sales taxesThe local sales tax consists of a 150 city sales tax. This is the total of state and county sales tax rates.

The Fremont sales tax rate is. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. The December 2020 total local sales tax rate was also 7750.

Did South Dakota v. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary. Wayfair Inc affect California.

Those district tax rates range from 010 to 100. The County sales tax rate is. New Sales and Use Tax Rates in Fremont East Bay Effective April 1 - Fremont CA - California State Board of Equalization officials say.

The Fremont County Sales Tax is collected by the merchant on all qualifying sales made within Fremont County. 1788 rows California Department of Tax and Fee Administration Cities. The Fremont County Sales Tax is 25 A county-wide sales tax rate of 25 is applicable to localities in Fremont County in addition to the 29 Colorado sales tax.

B Three states levy mandatory statewide local add-on sales taxes at the state level. Measure C in March and Measure W in November. The minimum combined 2021 sales tax rate for fremont california is 1025.

Fremont has seen the job market increase by 14 over the last year. 5 digit Zip Code is required. The hike came after voters passed two 05 percent tax hikes in 2020.

The Fremont County sales tax rate is. 1092 556 less Federal Income Tax. Tax Rates for Fremont - The Sales Tax Rate for Fremont is 93.

Those district tax rates range from 010 to 100. What is the sales tax rate in Fremont California. The County sales tax rate is.

The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax. This means that depending on your location within California the total tax you pay can be significantly higher than the 6 state sales tax. This is the total of state county and city sales tax rates.

Find out whats. The tax rate in most of those cities is now 1075 percent. Please ensure the address information you input is the address you intended.

California 1 Utah 125 and Virginia 1. Some areas may have more than one district tax in effect. Has impacted many state nexus laws and sales tax collection requirements.

The minimum combined 2022 sales tax rate for Fremont County Colorado is. You can print a 1025 sales tax table here. Groceries are exempt from the Fremont and Nebraska state sales taxes.

Type an address above and click Search to find the sales and use tax rate for that location. Glendale CA Sales Tax Rate. The Colorado state sales tax rate is currently.

These rates are weighted by population to compute an average local tax rate. There is no applicable city tax. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

For tax rates in other cities see California sales taxes by city and county. Some cities and local governments in Fremont County collect additional local sales taxes which can be as high as 3.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax Increase Passes In Pacific Grove Again Monterey Herald

California Vehicle Sales Tax Fees Calculator

How To Use A California Car Sales Tax Calculator

Is Shipping In California Taxable Taxjar

California Sales Tax Rates By City County 2022

Used Vehicle California Sales Tax And California Board Of Equalization

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

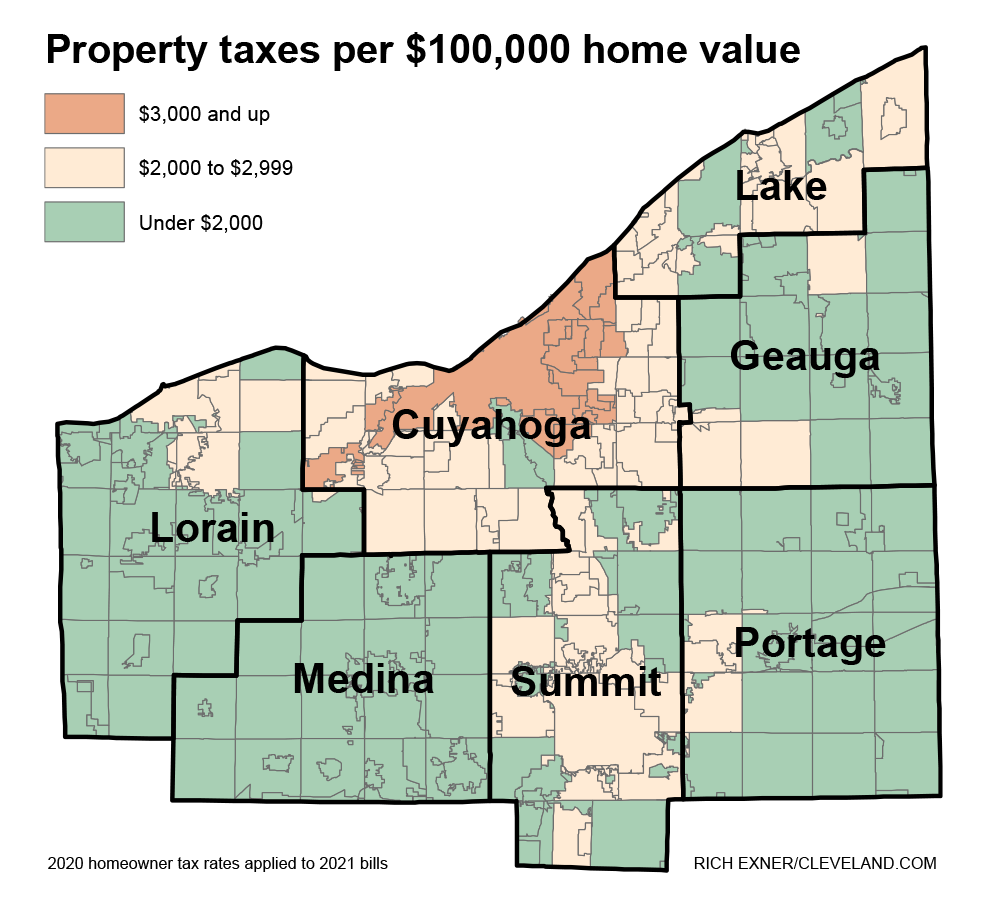

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

California City County Sales Use Tax Rates

Food And Sales Tax 2020 In California Heather

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Rate By County R Bayarea

Food And Sales Tax 2020 In California Heather

California Sales Tax Guide For Businesses